With any luck you might never ever encounter a scenario where you'll need to pay an insurance deductible, but it is necessary that you beware to choose a plan with a deductible that you can manage to pay - insurance company. Your insurance agent can aid you address your insurance deductible questions. Contact Tourists for your car insurance policy quote.

insurance companies cheapest car cheap auto insurance credit score

insurance companies cheapest car cheap auto insurance credit score

Right here are 10 ways to reduce your vehicle insurance policy. No one suches as to invest even more cash than needed on cars and truck insurance policy. These 5 ideas can help reduced auto insurance policy expenses. Selecting cars and truck insurance policy is a difficult Look at more info job given the wealth of carriers and also protection choices.

Your car insurance coverage deductible is generally a set quantity, state $500. If the insurance policy insurer identifies your claim quantity is $6,000, as well as you have a $500 insurance deductible, you will get a case repayment of $5,500 - insured car. Based on your insurance deductible, not every cars and truck accident warrants a case. If you back right into a tree resulting in a tiny damage in your bumper, the expense to repair it might be $600.

Deductibles vary by policy and chauffeur, and you can choose your automobile insurance policy deductible when you purchase your policy.

Compare quotes from the top insurance provider. Which Vehicle Insurance Insurance Coverage Kind Have Deductibles? Equally as there are different sorts of cars and truck insurance policy protection, there are differing deductibles based upon those various sorts of insurance coverage. It's vital to recognize just how much the automobile insurance policy deductible is for each and every type, so you'll understand what you're anticipated to pay in the occasion of a case. auto.

Facts About Understanding Your Car Insurance Deductible Revealed

Obligation auto insurance policy coverage does not have an insurance deductible. This coverage pays your costs if your auto is damaged by something aside from a crash with another car or things. This can include fixing damages from hail storm, hitting a deer or changing a cracked windshield. It additionally will certainly pay to cover the expense of replacing stolen items.

This insurance coverage pays for repair services to your vehicle when you are at fault. This can be when your cars and truck is harmed in an accident with an additional lorry or a things such as a tree or wall. This insurance deductible is normally the highest deductible you will certainly have with your car insurance plan.

Because instance, you would not pay a collision insurance deductible. Accident security coverage pays the medical expenditures for the chauffeur as well as all guests in your car. Without insurance motorist protection pays your costs when you remain in an automobile crash with a chauffeur that is at fault however does not have insurance policy or is insufficiently insured to cover your prices.

What Is the Ordinary Deductible Price? Because customers choose varying kinds of auto insurance policy protection with various financial limitations, deductibles can differ substantially from one driver to the following. For most chauffeurs, normal insurance deductible amounts are $250, $500 and $1,000. According to Money, Geek's data, the average auto insurance coverage deductible amount is around $500.

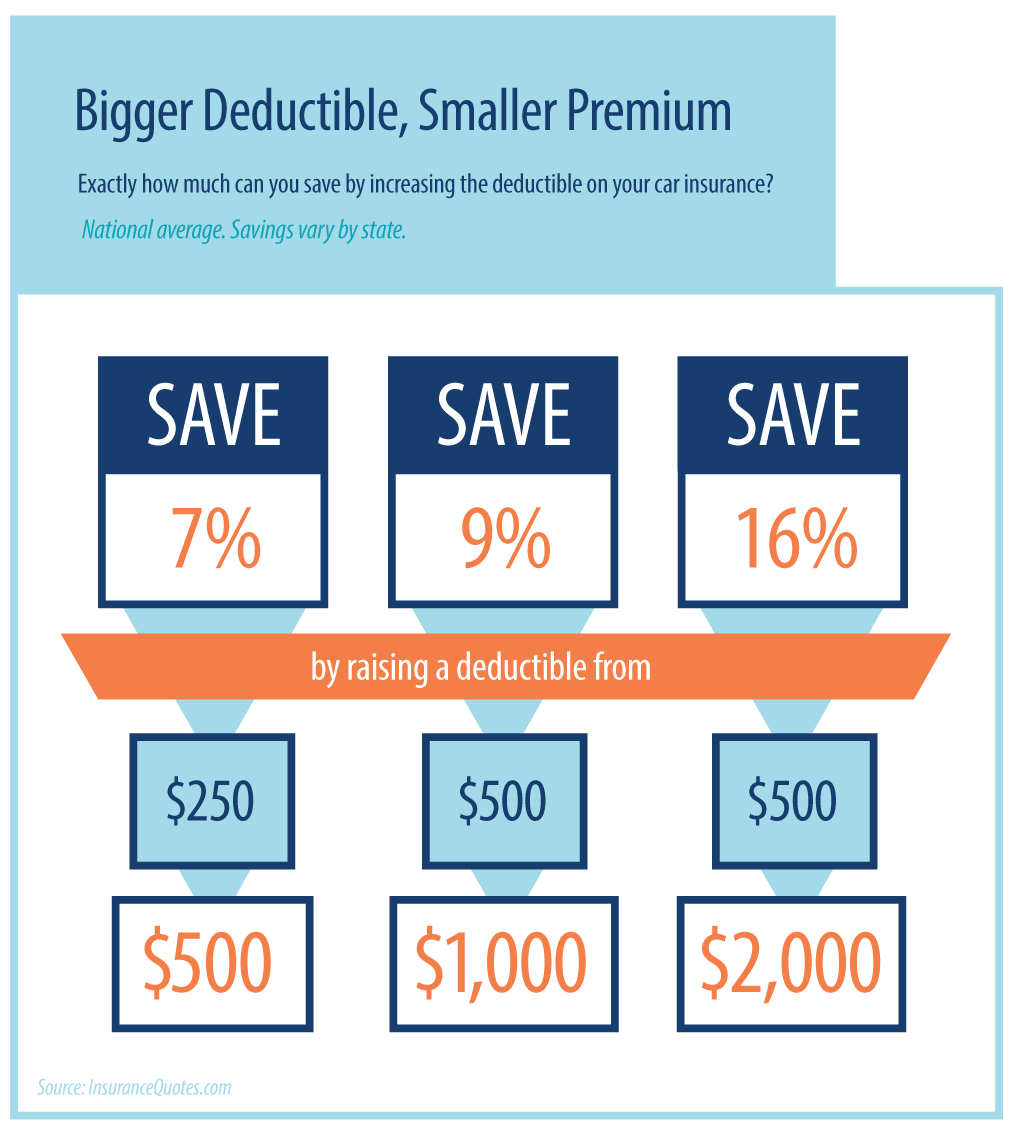

Your automobile insurance coverage deductible will vary based on that coverage and also the cost of your premium. Typically speaking, if you select a policy with a higher insurance deductible, your premium will be reduced. This can be a terrific option as long as you can pay that higher deductible in the event of an accident - vans.

How Car Insurance 101 - Car Insurance Faqs can Save You Time, Stress, and Money.

You can conserve an average of $108 per year by boosting your deductible from $500 to $1,000. For those with tight budget plans, picking a reduced costs as well as a greater insurance deductible can be a way to ensure you can pay for your automobile insurance policy. Nevertheless, if you can manage it, paying a greater costs can indicate you don't have to create a great deal of cash to pay a reduced deductible in case of a crash.

It's crucial to have your questions concerning cars and truck insurance coverage deductibles responded to before that occurs, so you know what to expect. EXPAND ALLWho pays a deductible in an accident?

If the at-fault driver does not have insurance coverage or enough insurance coverage to cover the various other vehicle driver's expenditures, the no-fault vehicle driver can use his vehicle insurance as additional protection to pay the costs. When do you pay a deductible if you are called for? Typically, if you are called for to pay a cars and truck insurance coverage deductible, the amount of the insurance deductible will certainly be subtracted from your insurance claim settlement when it is issued.

Can you avoid paying an insurance deductible? Basically, the only means to avoid paying a cars and truck insurance coverage deductible is not to sue. Or else, if you sue, expect to pay the insurance deductible. credit. While obligation protection does not call for a deductible, this protection pays the other motorist's expenditures for injuries and fixings, not your very own.

Compare quotes from the top insurer. Secret Details Regarding Cars And Truck Insurance Policy Deductibles, If you have automobile insurance policy, you will certainly need to pay an auto insurance deductible when you file a claim for repairs and injuries. Just how much you spend for your deductible depends on your vehicle insurance protection and just how much your vehicle insurance costs is - accident.

Not known Factual Statements About What Is A Deductible? - Njm

The at-fault vehicle driver in the crash is normally required to pay an automobile insurance policy deductible. Obligation insurance coverage does not need an automobile insurance coverage deductible, but only covers the expenditures of the various other motorist, not your own. About the Author.

Let's describe how deductibles work and also just how to choose the ideal one for your budget and coverage requirements. Merely placed, a deductible is the quantity of cash you'll have to add in the direction of clearing up an insurance coverage case.

Rare, there are some exceptions where an insurance deductible is non-applicable. If another insured chauffeur is accountable for your problems and injuries, a deductible does not use.

auto insurance cheapest insure insurance affordable

auto insurance cheapest insure insurance affordable

However, for brand-new cars and truck proprietors, the overview may not be as glowing. The average cost of a new vehicle is approximated to be $37,000, which results in greater costs (cheap). If you drive a new automobile as well as are associated with a significant accident, it can trigger thousands in damages (not to mention the capacity for injury) or amount to the lorry.

For chauffeurs with a high deductible, the majority of the repair costs would certainly drop on them. Piling Deductible, Before finalizing on the dotted line for your plan, you ought to confirm just how each circumstance is dealt with. The reason is that multiple insurance packages may have separate deductibles, which are collective. This is recognized as a "piling deductible," and the most effective way to depict just how this works is with an example: Allow's claim you were driving a cars and truck with 3 other guests as well as got hit by an uninsured chauffeur (low-cost auto insurance).

Fascination About What Is The Car Insurance Deductible? - Autoinsurance.org

Your deductible is established at $1000, as well as the contract specifies it is applied separately. This indicates you would certainly need to contribute towards vehicle repair services and the medical bills of every passenger. cheap insurance. For this reason, constantly ensure your insurance deductible is packed in as several conditions as possible to prevent circumstances of this nature.

Understandably, the likelihood of being involved in an occurrence climbs the more time you invest behind the wheel. So the more you drive, the lower the deductible need to be to assist make sure very little losses in case of an accident. If you're just placing in a couple of thousand miles per year, selecting a higher insurance deductible can save you cash on your premium costs, and also this difference might be able to assist contribute if a mishap does ever before occur.

While a deductible may not apply if you were not the vehicle driver at mistake, it does not necessarily protect you in instances where the accountable motorist is underinsured or uninsured (car insurance). The choice you make on your insurance deductible rate needs to refer personal preference. The price of an insurance premium ranges with the deductible, so locating the balance boils down to examining your budget as well as dangers of having an accident.

While elevating your insurance deductible will decrease your premium, there are various other impacts to take into consideration for your automobile insurance coverage costs. Let's take an appearance at all the elements you should take into consideration when choosing your automobile insurance deductible!

If you weren't needed to have a deductible, you could practically have as many mishaps as you desired on the insurance firm's penny. Paying a deductible ensures you likewise have a risk in any type of cases you make. Deductibles typically just relate to damage to your own home, like whens it comes to thorough and also collision automobile insurance policy. cheaper car.

Some Of Deductible Fund: How It Works - Liberty Mutual

cars cheapest auto insurance auto

cars cheapest auto insurance auto

What is the relationship in between the deductible and costs? Most frequently, a reduced insurance deductible means greater monthly payments. If you have a reduced deductible, you have much more protection from your insurance policy business as well as you have to pay less expense when it comes to a claim. A greater insurance deductible indicates a minimized expense in your insurance costs.

A low deductible of $500 indicates your insurance provider is covering you for $4,500. A greater deductible of $1,000 suggests your business would certainly after that be covering you for only $4,000. Because a lower deductible relates to more coverage, you'll need to pay even more in your regular monthly costs to cancel this increased coverage.

This depended on the state, however, where Michigan just saved 4% for the deductible raising while Massachusetts conserved an average of 17%. Some individuals make the mistake of picking the highest possible insurance deductible simply to save money on their costs. When it comes to an event, though, having a high insurance deductible can have serious monetary repercussions.

If you have that money on hand at any type of point, it could be worth choosing a greater insurance deductible. insurers. 2. What is the repayment? Do the math with your insurance policy representative. Just how much would you save money on a reduced costs if you had a higher insurance deductible? Would certainly you save cash that would certainly relate to that insurance deductible in the instance of an incident? Allows state that transforming from a $500 to $1,000 deductible would certainly save you 10% on your annual premium.

Now you have actually a boosted deductible by $500, but you are conserving $80 per year. If you do not obtain into an accident in those 6 years, the raised deductible was worth it - cheaper auto insurance.

Some Ideas on What Is A Deductible? - Njm You Should Know

If you have an excellent driving record, a higher deductible could work in your support. You'll save cash on the costs, which you might make use of towards your deductible when it comes to an insurance claim. A vehicle driver who hasn't had a crash in 20 years could not be scared by the above example of the 6-year time duration to make up the distinction. cheaper cars.

Ultimately, a greater insurance deductible is a greater threat. The reduced your insurance deductible, the extra protection and protection you have. If you do not obtain in a great deal of accidents, you can take the risk with a higher insurance deductible.

There are various other methods to reduce your premiums, like going shopping around and also packing your automobile and house insurance policy. Go here to find out about the 16 ways to lower your vehicle insurance policy costs. If you couldn't pay for to make your insurance deductible tomorrow, you need a lower insurance deductible. If you're a good motorist with a high tolerance for danger, you can increase your deductible.

There are other means to lower your costs, like shopping about and also packing your vehicle as well as home insurance policy. Click on this link to find out about the 16 means to reduce your car insurance coverage premium. If you could not pay for to make your deductible tomorrow, you require a reduced deductible. If you're a great driver with a high tolerance for threat, you can increase your deductible.